National Hotel Market Highlights

The U.S. lodging industry experienced modest contraction in the second quarter of 2025, as 1.0 percent growth in average daily rate was offset by a 1.4 percent decline in average occupancy, resulting in a 0.5 percent loss in RevPAR for the quarter. Total demand in the quarter slid by just 0.6 percent, while the room supply increased by 0.8 percent in the same period. Margins continued to contract on wages and non-operating costs, as insurance costs declined in some markets, but remained twice as expensive as 2019 levels on average.

The hotel industry continues to bifurcate into midscale and below properties with limited rate growth and growing high-priced “experiential” upscale and luxury hotels. The luxury category experienced a 4.4 percent increase in RevPAR, driven by a 5.3 percent increase in ADR but a loss of 0.9 percent in occupancy. The upper-upscale hotels experienced a modest decline in RevPAR of 0.2 percent, while the midscale category saw RevPAR decline by 1.7 percent and the economy sector saw RevPAR decrease by 3.4 percent in the quarter.

The overall decline in hotel fundamentals can be attributed to several factors. First, the economic outlook remains mixed throughout the first eight months of the year. Despite seeing US real GDP rise by 3 percent year-over-year, the combination of tariffs, federal layoffs and freezes on federal funds for certain research has led to an expectation of a slowing economy; CBRE Econometric Advisors’ baseline forecast calls for full-year real GDP growth of 1.5 percent for 2025 followed by 1.8 percent in 2026. Tariffs have increased the cost of some of the imported goods essential for hotel operations, such as linens, furniture, and construction materials, squeezing profit margins. The World Travel & Tourism Council forecasts a loss of $12.5 billion in international traveler spending in 2025, which would have a significant impact on the economy.

Cities that are highly reliant on international visitors, like New York City, Las Vegas and those along the Canadian border, are experiencing significant declines in demand and revenue. For example, hotel bookings in New York City fell 10 percent to 15 percent year-over-year. Las Vegas projects a 5 percent decline in room tax revenue due to reduced visitors from Canada and Mexico, while some border cities have seen demand declines of up to 5 percent.

Our projections call for flat demand and modest ADR growth representing a 1.0 percent increase in 2025, but a negative occupancy forecast of 0.9 percent. The combination of these factors results in a marginal 0.1 percent increase in RevPAR. However, because international demand varies by market, the risk of loss is higher in tourist destinations, while the Washington, D.C. area is most vulnerable to government demand loss. Some markets, like Chicago, are well-positioned to weather these risks.

Washington, D.C. Market Highlights

Historically, Washington, D.C. has been considered fairly recession-proof. The blend of the direct and indirect employment linked to the federal government, high levels of national and international inbound tourism demand and a robust meeting and conference calendar have traditionally buoyed the market from economic downturns. However, this is no longer the case.

The combination of tariffs, layoffs in the federal sector, and freezing research funding at institutions such as the NIH have caused major disruptions in the local economy. According to CBRE Economic Advisors, employment growth has fully stalled and is projected to be negative for the balance of 2025 as the federal positions that were previously eliminated reach the end of their “buy-out” periods and those former employees start filing for unemployment benefits. Some hotel managers noted that they continue to see healthy demand from international travelers, while others that are more focused on bus tour groups and low-to-mid priced tourism are seeing double-digit declines in demand, especially those that had catered to the Canadian and Asian travelers.

The Washington, D.C. market had posted a very strong RevPAR increase in the first quarter of 2025 due to the ability of hotels to push rates during the presidential inauguration. In fact, the market-wide ADR increased by more than 11 percent in the first quarter. Coupled with demand that outpaced supply growth in the quarter, the market realized positive occupancy gains of 0.4 percent, leading to a RevPAR increase of 11.6 percent.

The second quarter of the year, however, was a different story. Market-wide demand fell by 1.4 percent while supply increased by 2.0 percent, leading to a 3.4 percent decrease in occupancy. Further, the market ADR fell by 2.1 percent in the quarter resulting in a 5.4 percent loss in RevPAR.

Looking at the market by pricing segment, the upper-priced hotels experienced a 5.2 percent decline in RevPAR in the second quarter, while the RevPAR of mid-priced hotels fell by 6.7 percent. The lower priced hotels only saw RevPAR decline by 0.9 percent in the quarter, driven by a 2.1 percent reduction in ADR.

Tourism Economics released an updated forecast in August, which predicts that Washington, D.C. will experience a 5.1 percent drop in international visitors in 2025. We do note that through May of 2025, international passenger activity at Dulles International Airport was up by 3.9 percent year-to-date.

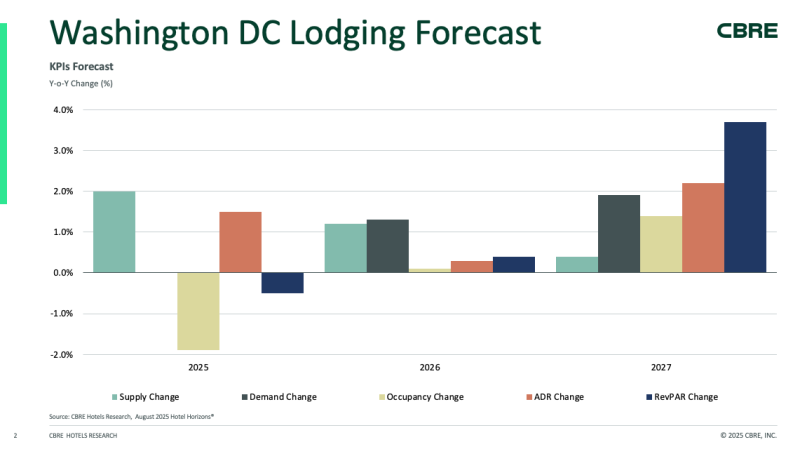

The outlook for market-wide occupancy in 2025 is expected to be 1.9 percent lower than in 2024, while ADR is expected to see modest improvement of 1.5 percent. The market-wide RevPAR is projected to be 0.5 percent below the level of 2024.

David Fuller, MAI is the Mid-Atlantic hotels advisory expert in the CBRE Hotels Valuation & Advisory group. He is based in the firm’s Bethesda, Md., office and can be reached at David.Fuller@cbre.com.